Calm seems to be returning to the market. The VIX is back at levels favorable to price expansion, demonstrating a certain optimism. More local derbies possible, all info on the draw for the second round

The first round of the DFB Cup is almost over and there are still a few local clubs left in the running. Find out when the next matches will be drawn and who is still in the competition.

Three out of three possible local clubs have reached the second round of the DFB Cup. Schalke 04 defeated Lok Leipzig 1-0, VfL Bochum beat BFC Dynamo 3-1. And then there was the direct duel between Rot-Weiss Essen and Borussia Dortmund, which ended 1-0 in favor of BVB. Will Borussia Dortmund face FC Schalke 04 once again? Or will VfL Bochum have to take on one of its two neighbors? Fans will find out on Sunday, August 31, at 7 p.m., when former referee Dr. Felix Brych will draw the second-round matchups.

By then, the last two participants in the second round of the DFB Cup will also be known. On Tuesday, August 26, at 8:45 p.m., second division team Eintracht Braunschweig will take on reigning DFB Cup winner VfB Stuttgart. August at 8:45 p.m., reigning German champions FC Bayern Munich will face third-division side Wehen Wiesbaden. Why are Bayern Munich and VfB Stuttgart playing at different times? Instead of the DFB Cup match, the Franz Beckenbauer Super Cup will be played on Saturday evening of the cup weekend. This year, FC Bayern Munich won 2-1 against VfB Stuttgart and secured the first “title” of the new 2025/26 season.DFB Cup: All teams in the second round at a glance Bundesliga: Bayer 04 Leverkusen Union Berlin Hamburger SV 1. FC Heidenheim

TSG Hoffenheim

RB Leipzig

FC St. Pauli

VfL Wolfsburg

SC Freiburg

Eintracht Frankfurt

1. FC Köln

Borussia Mönchengladbach

FC Augsburg

1. FSV Mainz 05

Borussia Dortmund

2. Bundesliga:

1. FC Magdeburg

Arminia Bielefeld

VfL Bochum

SV Darmstadt 98

SC Paderborn 07

SpVgg Greuther Fürth

Karlsruher SC

1. FC Kaiserslautern

Holstein Kiel

SV Elversberg

FC Schalke 04

Fortuna Düsseldorf

Hertha BSC

3. Liga:

Energie Cottbus

Regionalliga:

FV Illertissen

DFB-Pokal: Die Termine im Überblick

2. Runde: 28./29. Oktober 2025

Achtelfinale: 2./3. December 2025

Quarter-finals: February 3/4 and February 10/11, 2026

Semi-finals: April 21/22, 2026

Final: May 23, 2026

me of traditional investors. The crypto market, for its part, is benefiting from this optimism, but as always, the gains are not linear. So, what should we be watching out for with Bitcoin?

Is the market anticipating good news?

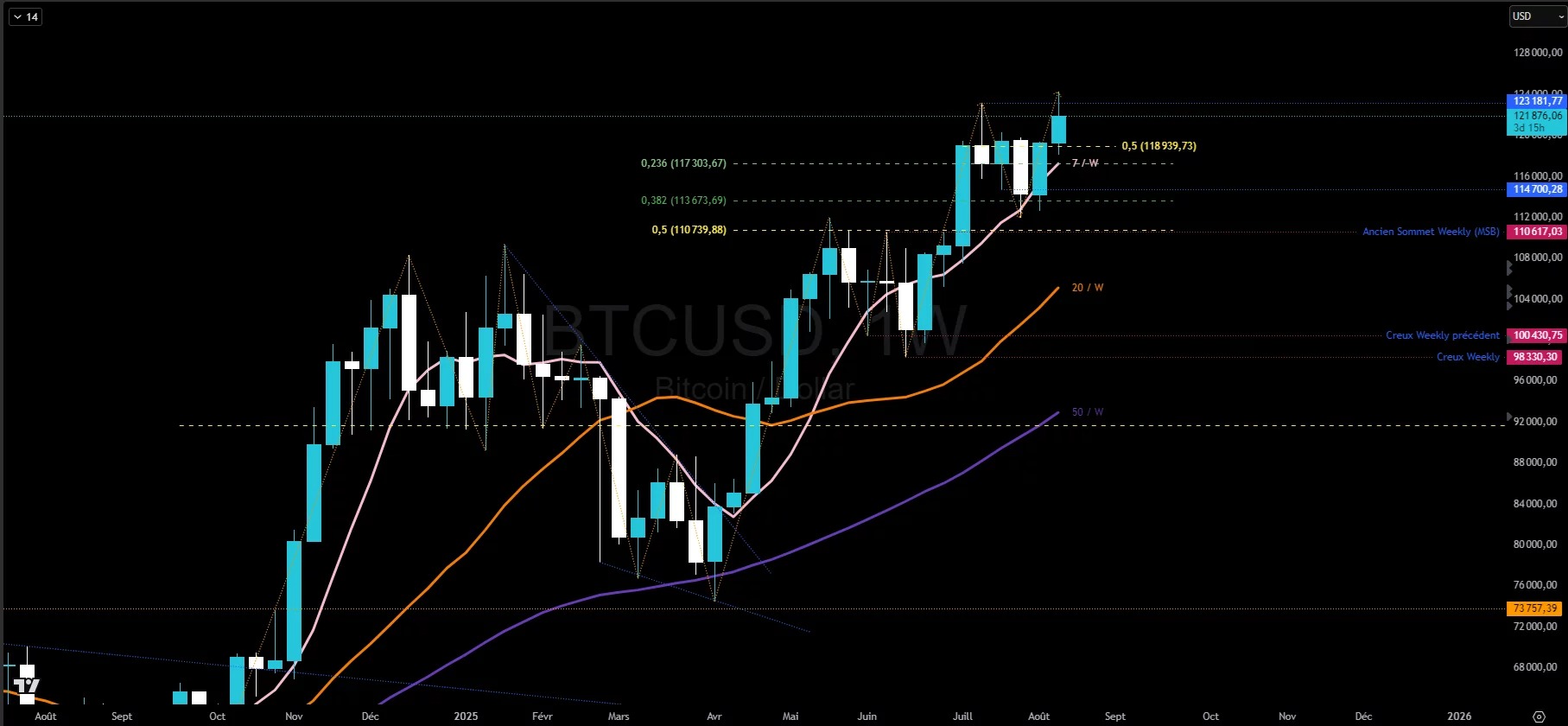

On Monday, August 14, 2025, at 11:00 a.m., at the time of writing, Bitcoin is trading at around $121,600, a level it reached after hitting a new all-time high.

The market is now moving forward with confidence: rate cuts seem certain for the end of the year. In light of the data released, the job market is in sharp decline, and inflation, although picking up slightly, remains contained, despite still being above the central bank’s target.

Financial players consider the slowdown in employment to be a decisive factor that could prompt the central bank to cut its key rates at its next meeting.

Other positive news is boosting investor optimism, notably the various postponements of tariffs with China and diplomatic progress that suggests a willingness to end the Russian-Ukrainian conflict.

All of these factors are pushing the VIX toward a level that is historically favorable for stock market gains.

The fear index fell below 15 on Wednesday, standing at 14.65 at the time of writing. The derivatives markets are showing some signs of optimism, but do not appear euphoric this Thursday morning: open interest is high, but the bias, while positive, remains reasonable.

Most of the long liquidations are to be found in the $114,000 zone. For shorts, it will probably be necessary to work the zone some more before pushing north, seeking to reach the $125,000 zone where limit orders are waiting for prices.

In terms of capitalization, Bitcoin retains its leading position, with an estimated valuation of $2.424 trillion. Its dominance has fallen below 60%, closing below the 50-week moving average for the second consecutive day (based on 3-day data): an important technical signal that could indicate that the market is shifting towards a recapitalization of altcoins.

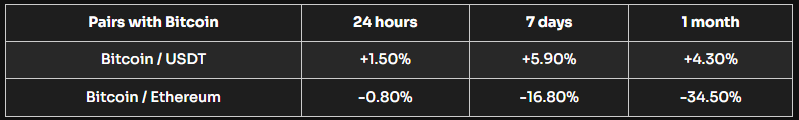

BTC performance indicators remain positive against the dollar, although its underperformance against Ethereum is now evident over the analysis period.

Consolidation ahead for Bitcoin?

The bullish movement that began in early August swept through the entire consolidation zone in the space of two weeks.

Now at the top of the working zone, between the previous historic high reached in mid-July and the confluence zone around $110,000, the possibility of a new consolidation phase is one of the scenarios to consider.

This scenario is particularly plausible since all eyes are on the north, but Bitcoin is currently losing relative strength, particularly to Ethereum.

Thus, a potential bull trap could emerge, which would make sense if the weekly close were below $123,181, marking a high above the previous weekly high.

Of course, momentum remains favorable for the movement to continue. Currently seeking its weekly high, BTC is in a positive dynamic that it will maintain as long as it closes above $119,000 on a 3-day basis.

On a daily basis, the formation of a range between the historic highs and $114,700 remains a valid hypothesis. Thus, if we were to enter consolidation again, the area around the former 3-day low could be a favorable zone for a bullish recovery.

This hypothesis takes into account the bearish excess seen in early August, which perfectly aligned with the 50-day moving average. Its upward slope could cause it to rise rapidly, gradually gaining ground and raising the closing threshold below which Bitcoin would lean toward a correction rather than consolidation. Indeed, the positive momentum could change shape if a double close below the SMA50D were to materialize.

In summary, Bitcoin is performing well, reaching a new all-time high last night. However, speculators are gradually rearing their heads, making the market riskier. In addition, consolidation could develop if a bull trap were to materialize. Two key elements will need to be monitored: the weekly close, which, to avoid any doubt, must be above $123,181, and $119,000, which ensures positive polarity.

So, do you think BTC could reach $150,000? Feel free to share your thoughts in the comments below.

Have a great day, and we’ll be back next week with a new Bitcoin analysis.