While a company from the United Arab Emirates financed the crypto project World Aufstiegsgarant Kother? The remarkable record of the winter signing

After 22 match days, MSV Duisburg is fully in the promotion race in the 3rd league. New signing Dominik Kother could continue an impressive personal streak.

After Aljaz Casar (Dynamo Dresden), Lex-Tyher Lobinger (Viktoria Köln), and Dominik Becker (most recently without a club), MSV Duisburg presented Dominik Kother as its fourth signing in the 2026 winter transfer window on deadline day.

The 25-year-old winger, who can play on both flanks, is moving from Dynamo Dresden, where he has a contract until summer 2027, to Wedau on loan until the end of the season. He has played twelve games for the Saxons in the current 2. Bundesliga and also played in the DFB Cup match against Mainz 05.

The 1.80-meter-tall winger played a major role at Jahn Regensburg in the 2023/24 season, helping the Bavarian club reach the relegation play-offs. With ten goals and eleven assists, Kother played a major part in Regensburg’s successful campaign. He made the difference in the two close relegation matches against Wehen Wiesbaden. In the first leg, which ended 2-2, he scored one goal and set up another. In the 2-1 victory in the second leg, he also contributed a goal and an assist, helping Jahn return to the 2nd Bundesliga.

However, things didn’t really work out for the 25-year-old there. After 14 appearances (one goal, one assist), he left Regensburg in January 2025 and joined Dynamo Dresden. And in the lower division, Kother once again made his mark. With six goals and three assists in the second half of the season, he played a major role in helping the Saxons finish second in the table and earn promotion to the 2nd division. MSV Duisburg is now clearly hoping for a similarly successful half-season from Kother. On Sunday, the new signing could pull on the Zebra jersey for the first time in the top match against SC Verl.

Liberty Financial, owned by the Trump family, the Wall Street Journal reveals a significant conflict of interest. What are the ins and outs of this agreement?

The Wall Street Journal reveals curious links between Donald Trump and the United Arab Emirates

On Saturday, the Wall Street Journal published an impressive report implicating Donald Trump, his family, and his friends in an investment by the United Arab Emirates in his company World Liberty Financial (WLFI).

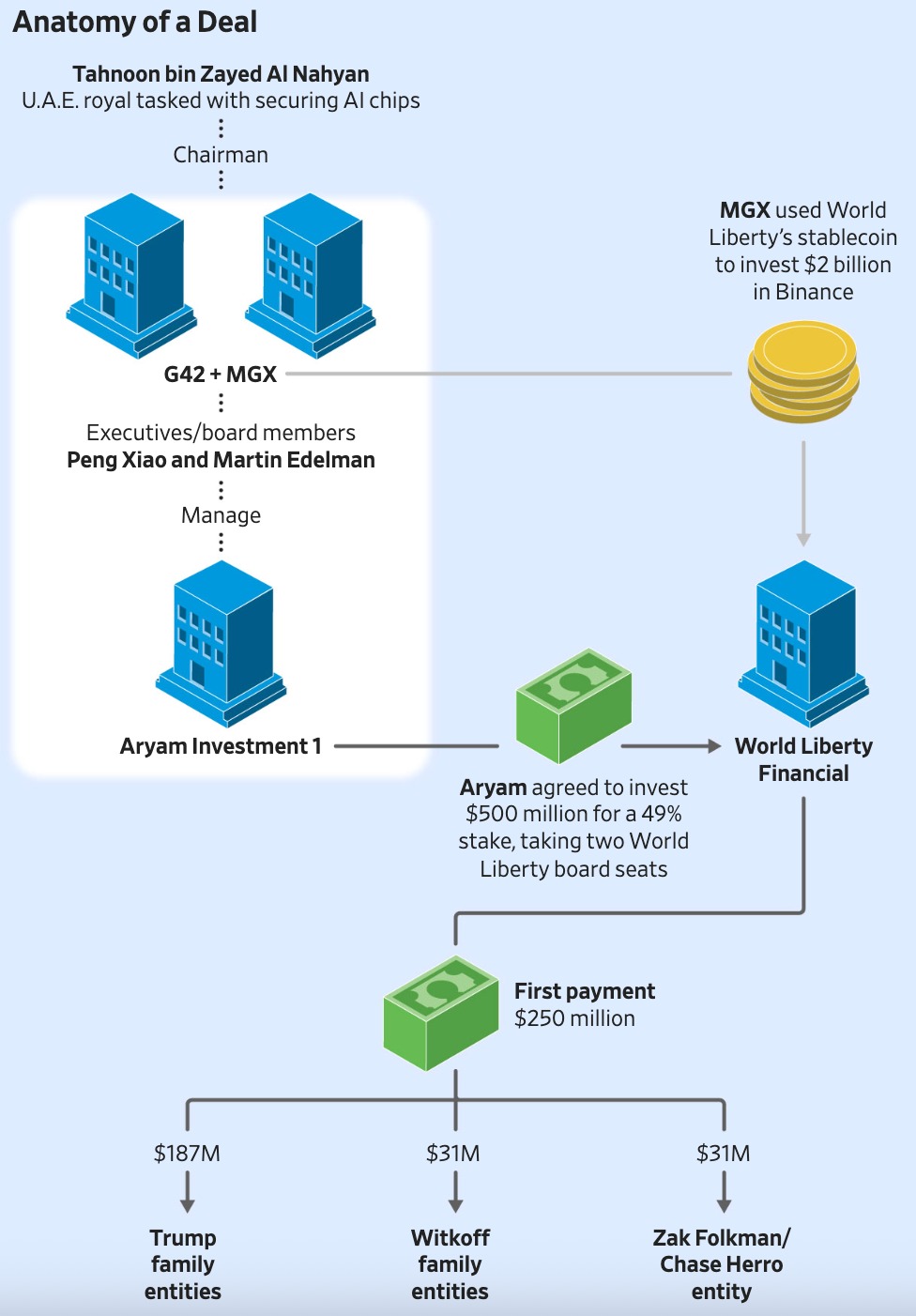

In summary, the report suggests that a $500 million investment facilitated access to “highly secure artificial intelligence chips” for companies owned by Tahnoon bin Zayed Al Nahyan, the brother of the President of the United Arab Emirates.

In concrete terms, the same report identifies close links between numerous players, echoing certain rumors and information that we have been able to relay over the past 12 months.

Firstly, it should be noted that Tahnoon bin Zayed Al Nahyan is one of the world’s largest private investors and that three of his companies feature repeatedly in this case: G42, MGX, and Aryam Investment 1.

The Wall Street Journal reports that four days before Donald Trump’s inauguration, Tahnoon bin Zayed Al Nahyan signed a $500 million deal to acquire a 49% stake in World Liberty Financial.

This was the result of a visit by Eric Trump to a crypto conference in Abu Dhabi in December 2024, as well as a visit by Steve Witkoff, a long-time friend of the US president, co-founder of World Liberty Financial, and special envoy to the Middle East.

A week after this visit, two entities named Aryam Investment 1 were registered two days apart, in Abu Dhabi and Delaware. It was this company that allegedly provided the funds used to acquire 49% of the Trump family’s crypto company, at least half of which was paid to various individuals.

This investment gave G42 and MGX seats on the board of directors of World Liberty Financial.

However, as the chart below shows, MGX is also the company that invested $2 billion in Binance last year using the USD1 stablecoin. At the time, MGX simply described the stablecoin as a “superior product” without revealing the close links between the various players:

Through these various connections, the Wall Street Journal questions the role that Tahnoon bin Zayed Al Nahyan may have played in Changpeng Zhao’s (CZ) pardon. And with good reason, as the founder of Binance lives in Abu Dhabi and also has Emirati citizenship. Furthermore, this pardon may have facilitated the granting of a global license to Binance by the Abu Dhabi Global Market, with a view to establishing a global headquarters there.

Moreover, this pardon came in October, just one month after MGX invested 15% in TikTok’s US entity, allowing the social network to continue operating on American soil.

In addition, while Tahnoon bin Zayed Al Nahyan has long been interested in AI, the Biden administration had restricted his access to US chips, fearing that this technology would benefit China due to his ties to Huawei.

However, two months after a meeting at the White House with the interested party in March 2025, the Trump administration committed to supplying 500,000 AI chips to the United Arab Emirates, about a fifth of which would be reserved for G42.

While it is important to remain cautious in the face of all these revelations, it is clear that this raises questions about the links that can sometimes be forged behind the scenes for various agreements.