American online brokerage giant Robinhood is setting up shop in Europe with some big announcements unveiled at the EthCC in Cannes: tokenized stocks on Arbitrum, perpetual contracts on Bitcoin and Ether, and even the launch of its own layer 2.

An aggressive strategy to conquer the European market and 400 million potential new customers.

Relatively unknown to the general public in Europe, Robinhood is an American financial services company founded in 2013 by Vladimir Tenev and Baiju Bhatt. Based in Menlo Park, California, it made a name for itself by offering an intuitive mobile app that allows individuals to invest in stocks, ETFs, options, and cryptocurrencies without commission fees.

Today, Robinhood is coming to Europe and aims to win over some 400 million people. To raise awareness, the platform took advantage of the EthCC currently taking place in Cannes to unveil a series of major announcements.

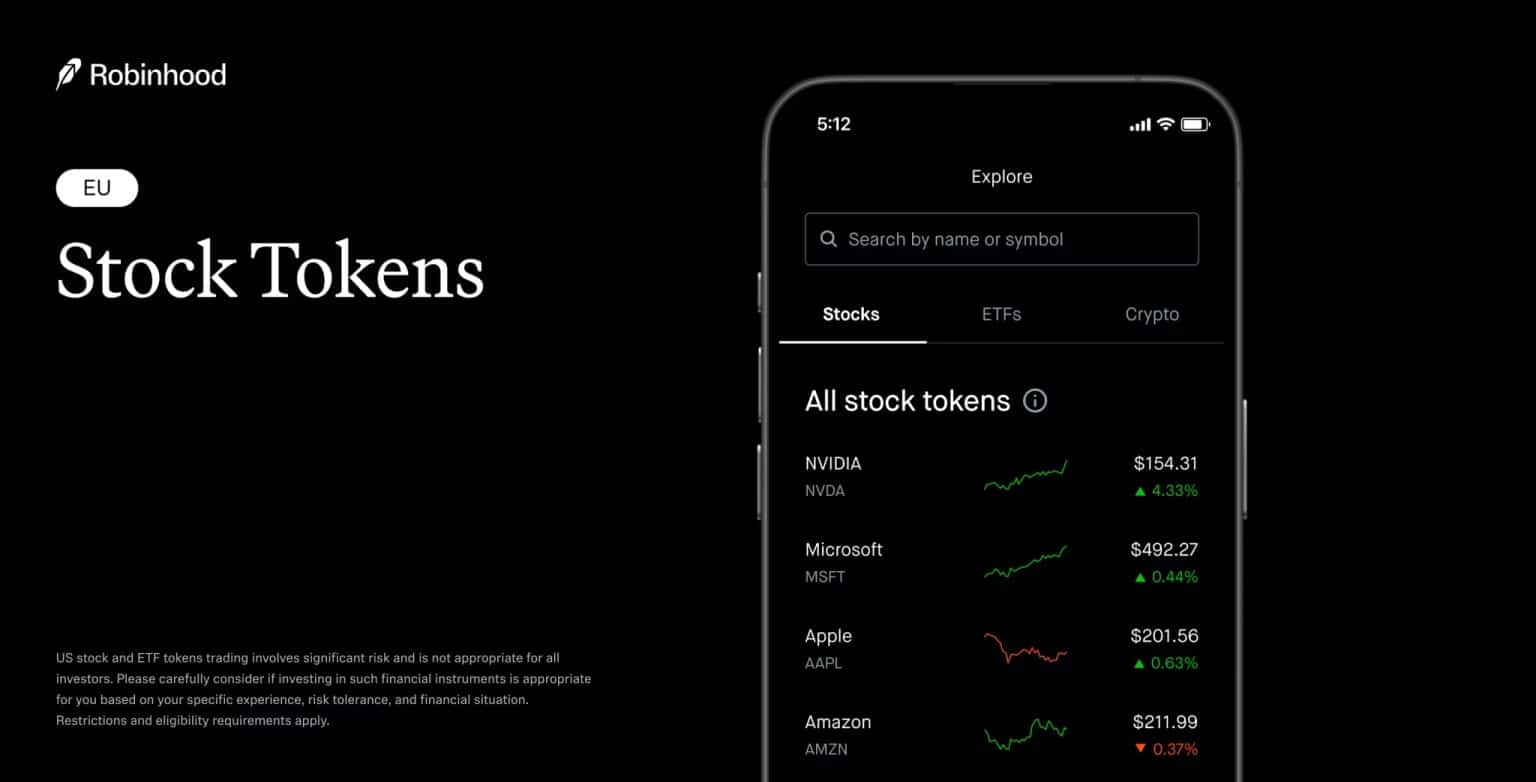

First, Robinhood is launching a zero-commission offering of tokenized US stocks—200 stocks and ETFs, to be exact. For this offering, the platform is using Arbitrum (ARB), a well-known layer 2 of the Ethereum (ETH) blockchain.

During the presentation, Johann Kerbrat, Robinhood’s head of crypto, announced that in addition to traditional stocks, European investors will also be able to gain exposure to private companies such as OpenAI and SpaceX.

What we talked about on stage was how to address the inequality between those who have historically had access to these types of companies and everyone else. That’s what’s really exciting: now everyone will be able to access them. The goal of tokenization is to allow everyone to participate in this economy.

Johann Kerbrat

Recently, tokenized stocks have been gaining momentum. Two days ago, Gemini, the Winklevoss brothers’ crypto platform, made a similar announcement. Kraken, another crypto exchange, announced xStocks earlier this month, although it is not yet available in the European Union. And Coinbase, which is in a hurry, is reportedly preparing a similar offering.

In other news, Robinhood plans to launch perpetual futures contracts on Bitcoin and Ether by the end of the summer, again for its European customers. Perpetual contracts are instruments that allow traders to take leveraged positions on a continuous basis, with no expiration date. These are expected to be offered with leverage of up to a factor of 3.

And, most importantly, its own layer 2

Finally, Robinhood announced that its own blockchain is under development. Launched as a layer 2, it will be based on Orbit, an open source framework developed by Offchain Labs, the firm behind Arbitrum.

An “Orbit Chain,” about which we still know very little, except that it will be optimized for tokenized real-world assets (RWA), trading, bridging, and self-custody.

Robinhood is now onchain with Arbitrum!

Arbitrum will serve as @RobinhoodApp‘s rails to merge DeFi and TradFi in what is a 0 – 1 moment for the entire industry. All while onboarding millions of net-new users into crypto. Arbitrum Everywhere. pic.twitter.com/lHPUEI4E54

— Arbitrum (@arbitrum) June 30, 2025

Robinhood’s stock, which trades under the ticker HOOD, benefited greatly from the news.

Up 11.6% today, it is trading at an all-time high of $92.50.

HOOD_2025-06-30_21-35-29-1536×36-1.jpg” width=”1536″ height=”366″ />

Vlad Tenev, Robinhood’s CEO, has made no secret of the platform’s ambition to conquer the world: “Our latest offerings lay the foundation for crypto to become the backbone of the global financial system,” he said.